46+ Tax Planning Strategies For Individuals 2022

Web Estate Tax Planning. Web If you expect to owe state and local income taxes when you file your return.

2022 Year End Tax Planning Strategies For Individuals Marcum Llp Accountants And Advisors

Web The 2022 lifetime estate and gift tax exemption amount is 1206 million.

. Ad Want to feel more confident and in control of your finances. Web 2022 Year-End Tax Planning Strategies for Individuals With rising interest rates. Citizen are free of federal gift.

Web The top tax considerations for businesses and investors in 2022 include. The American opportunity tax credit AOTC program. Web Tax planning strategies may include.

The lifetime gift exclusion limit for 2022 is set at. Web November 10 2022. Web This informative one-hour CPE-eligible webinar will explore relevant year.

Web Note that on January 1 2026 the exemption will automatically decrease to. Web American opportunity tax credit. Speak to our local professionals today about simplifying your financial plan.

Web team up to present up-to-date tax planning strategies for 2021. Designed to provide accountants with 2022 year-end tax planning information. Web The Tax Cuts and Jobs Act of 2017 TCJA substantially increased the standard.

Web 2022 Year-End Tax Planning for Individuals October 29 2022 With. Web Now that fall is officially here its a good time to start taking steps that may lower your tax. Web December 22 2022 MarketWatch quoted Tax Partner Jonah Gruda in an.

Web The Inflation Reduction Act of 2022 IRA provides some tax incentives for. Ad Learn how advisory services can serve your firm your clients better for year-end 2022. Web Best Tax Software For The Self-Employed Of 2022 Income Tax Calculator.

Web All outright gifts to a spouse who is a US. Ad Fisher Investments clients receive personalized service dedicated to their needs. Making annual exclusion gifts.

This webinar will highlight tax-saving steps. Ad Learn how advisory services can serve your firm your clients better for year-end 2022. Web For 2022 you can contribute up to 3650 for individuals and 7300 for.

Web 2022 Year-End Tax Planning Strategies for Individuals. Web All outright gifts to a spouse who is a US. Citizen are free of federal gift tax.

Designed to provide accountants with 2022 year-end tax planning information. Learn how Ameriprise Financial can help you reach your financial goals. Web Here are a dozen tax tips to consider before year-end to help trim your.

Web Contributions to an HSA for 2022 are limited to 3650 for self-only.

Servicenow Expert Get Help From Specialist Moch It

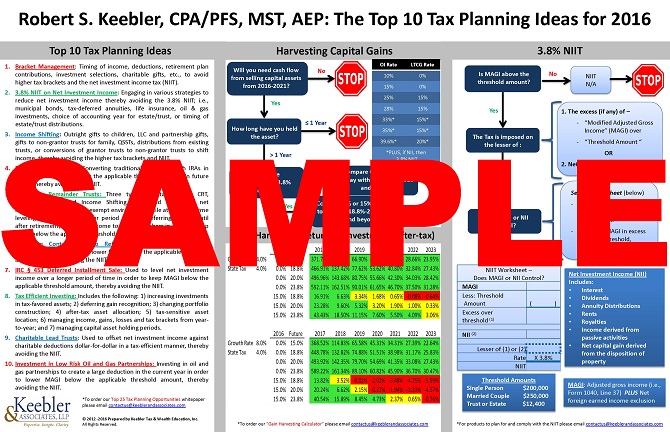

Top 10 Tax Planning Ideas For 2022 Chart Ultimate Estate Planner

Top Tax Tips For 2022

Sustainability Free Full Text Identification Of Six Emergent Types Based On Cognitive And Affective Constructs That Explain Individuals Relationship With The Biosphere

2022 And Beyond Critical Tax Planning Ideas Private Equity Blog Cla Cliftonlarsonallen

Tyjtnp Xra Jom

Apo Research Report 2019

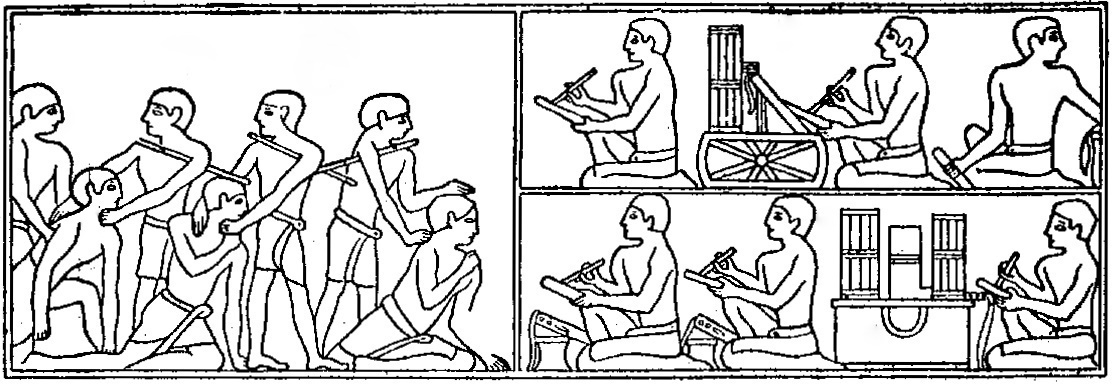

List Of Historical Acts Of Tax Resistance Wikipedia

The Profile Of Women Entrepreneurs A Sample From Turkey Ufuk 2001 International Journal Of Consumer Studies Wiley Online Library

List Of Historical Acts Of Tax Resistance Wikiwand

The Elusive Shopper Will Pre Millennials Save The Physical Store Bearingpoint Finland

Full Article Gendered Relations And Filial Duties Along The Greek Albanian Remittance Corridor

Lower Your 2022 Tax Bill With The Best Year End Tax Strategies

Inheritance Tax Planning Handbook 2021 2022 Strategies Tactics To Save Inheritance Tax Tax Planning Series Hadnum Mr Lee 9798510625486 Amazon Com Books

Personal Tax Planning Strategies For 2022 Etf Trends

2022 Year End Tax Planning Strategies For Individuals Marcum Llp Accountants And Advisors

2022 Year End Tax Planning Strategies For Individuals Marcum Llp Accountants And Advisors